Sales of Tesla (TSLA) are currently going down in China, based on both new monthly and weekly data released today.

It is despite the new model Y, registration discounts and incentives. Competition and a new electric vehicle (EV) Price War puts considerable pressure on Tesla in China.

Tesla experienced a slow first quarter globally, including in China, but the carmaker attributed to this model Y design transition, reducing production throughout the quarter.

The company does not have this problem in the 2nd quarter, and in fact it benefits from exalted demand for the new version of its best -selling car from the first quarter.

Still, the data now suggests that Tesla was priesting worse in Q2 than in Q1 in China, and they are also significantly underpeted significantly compared to the same period last year.

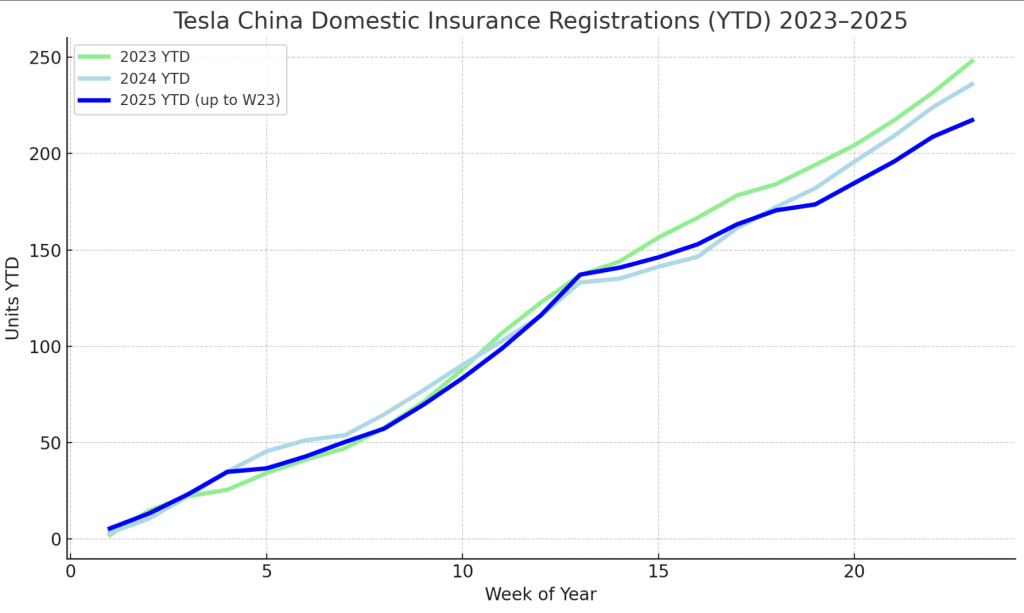

New insurance registration data from China was released today, confirming that Tesla only sold 8,600 vehicles in China during the first week of June.

This is far below expectations and a drop more than 4,000 units compared to the previous week, despite the fact that Tesla generally increased domestic deliveries during the last month of the quarter.

Tesla’s deliveries in 2025 now lag 2024 with approx. 20,000 units:

These lower sales come despite the fact that Tesla has higher discounts on its set -up than in the same period last year, including 0% interest.

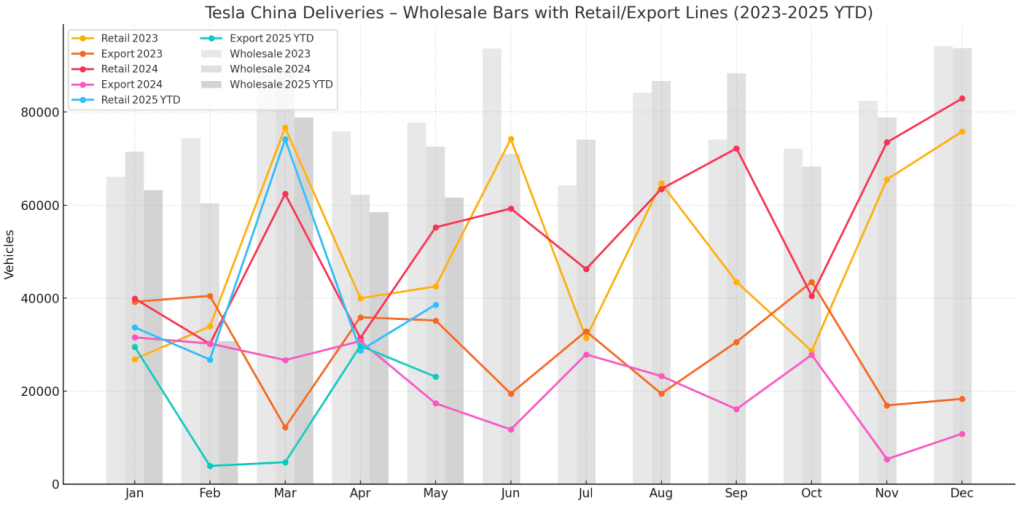

May Retail and Export Data was also released, confirming that Tesla delivered 38,588 vehicles in China and exported 23,074 cars from China in May.

In total, 61,662 units are during the same period last year. Tesla’s wholesale supplies in and from China have been down every month in 2025:

Tesla’s lower performance in 2025 is especially about the sale of electric vehicle in China. They rose 35% in the first quarter and the trend continues in the second quarter.

Competition steals sales from Tesla and things are expected to get worse as bids just triggered a new EV -Prize war in China with significant new price declines.

Electek Tag

This data is clear: Tesla faces a demand collapse in China. The company sat on its lead for too long and bet on everything on autonomous driving.

Now it has a limited and stale vehicle arrangement that the competition either surpasses or underbuded in price.

This has been the case in the last two years in China, where competition is the strongest, but Tesla has received by reducing prices and offering interest -free loans.

The result is that Tesla’s gross margins on vehicles sold in China (almost exclusively RWD Model 3 and Model Y vehicles) practically do not exist.

Tesla can’t afford to lower prices much more without starting to lose money.

When BYD started a new price war and targeted competition coming from Xiaomi Yu7, the second half of the year could prove to be very difficult for Tesla in China.

FTC: We use income that earns Auto -connected links. More.